tuition

On Thursday at the University of Massachusetts Boston, higher education leaders met with Massachusetts Senator Elizabeth Warren to discuss ways to control the cost of college and help students graduate with less debt. WGBH's Kirk Carapezza was there:

Representative Elijah Cummings of Maryland also attended yesterday's event. Listen to Kirk's extended interview with him and Senator Warren.

The president didn’t say much about college affordability in his state of the union address this week, unlike in previous years, but some members of Congress are pushing the issue. U.S. Rep. Suzanne Bonamici (D-Ore.) introduced a bill Wednesday that would waive tuition at public universities. Instead, students would pay a percentage of their incomes after graduation.

The recession may be over but its effects still linger at public colleges and universities.

The recession may be over but its effects still linger at public colleges and universities.

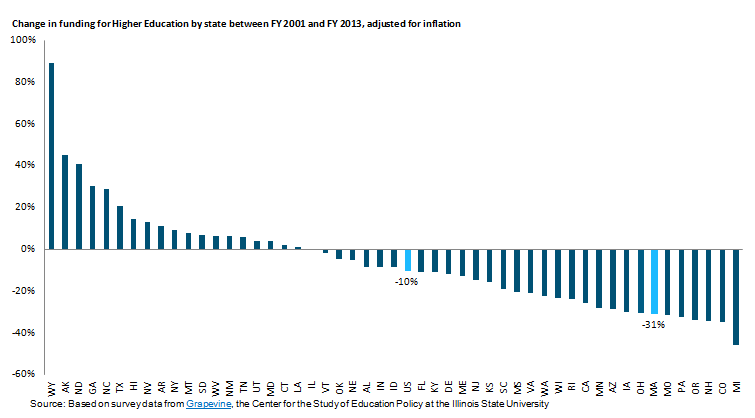

After facing declining revenue during the longest recession since the 1930s, many state governments continue to defund public institutions of higher learning.

A new report released this month by the Massachusetts Budget and Policy Center finds state funding for public higher education in Massachusetts has fallen 25 percent since 2001.

The federal government has shut down, so now what? What does the gridlock in Washington mean for students and faculty in the land of higher ed? With no end in sight, here’s what we know so far.

The federal government has shut down, so now what? What does the gridlock in Washington mean for students and faculty in the land of higher ed? With no end in sight, here’s what we know so far.

At a time of growing economic inequality in America, Wesleyan University President Michael Roth urges colleges and universities to create a culture in which low-income students can thrive.

"America today is a land of much greater distance between the haves and the have-nots," Roth writes. "It’s always been the case that wealthy students could have a very different experience than those of limited means, but today the social distance created by that economic gap is so great that it can undermine campus learning."

He may be the leader of the free world, but when President Barack Obama proposed that the government grade universities based on their cost and success rates, a lot of other people were ahead of him.

At a time when students and their families are demanding to know what they’re getting for their mounting investments in higher education, several foundations and research centers are already working on new ways to show them.

The cost of college has skyrocketed in recent decades, and few higher education observers say they know how to reengineer the affordability problem.

A chart produced by Bloomberg shows shows that tuition expenses have spiked 538 percent since 1985. That's compared to a 286 percent increase in medical expenses and a 121 percent increase in the consumer price index.

Private, for-profit colleges have joined the march of institutions that appear to be lowering their tuition as enrollment flattens out and families become increasingly price conscious.

The average tuition paid by students at four-year, for-profit colleges, when adjusted for inflation, fell from $16,268 in the 2006-2007 academic year to $13,819 in 2011-2012, the independent think tank Education Sector reports, citing data from the U.S. Department of Education.