Melanie Daye and her twin sons in a photograph that hangs on her kitchen walls (Mallory Noe-Payne/WGBH).

Listen to Melanie Daye talk about paying for education:

Melanie Daye has worked hard her whole life and is proud she’s achieved a piece of the American dream, owning her own home in Hyde Park in Boston. She says her greatest accomplishment, though, was singlehandedly raising her two boys -- and sending them both to college.

Now that college selection season is in full swing, you hear all the time about crushing student loan debt. Debt that is forcing young people to put off some of life’s most important milestones. But what about parent debt? There are new concerns over a federal program that allows mom and dad to shoulder the burden, Parent PLUS Loans.

When asked about the toughest part of raising twins, Daye doesn't hesitate to talk about college.

“Them staying out of trouble, them doing their homework, them coming in on time, them sassing…putting them through college,” said Daye.

Putting them through college on her own, and off realtor’s commissions, wasn’t easy -- but Melanie was committed.

“I try to get them what they want because they’re the only kids I have and I love them," Daye said. "That’s why I gave them what they wanted.”

Antwane wanted to go to University of Hartford and Teyon wanted to go to Becker College for a grand total of $170,000. Although the boys themselves took out college loans, it still wasn’t enough. Melanie applied for Parent PLUS Loans, a federal program that allows families to borrow enough money to cover the full cost of attending school. Her loan totaled over $100,000, but the end result was gratifying.

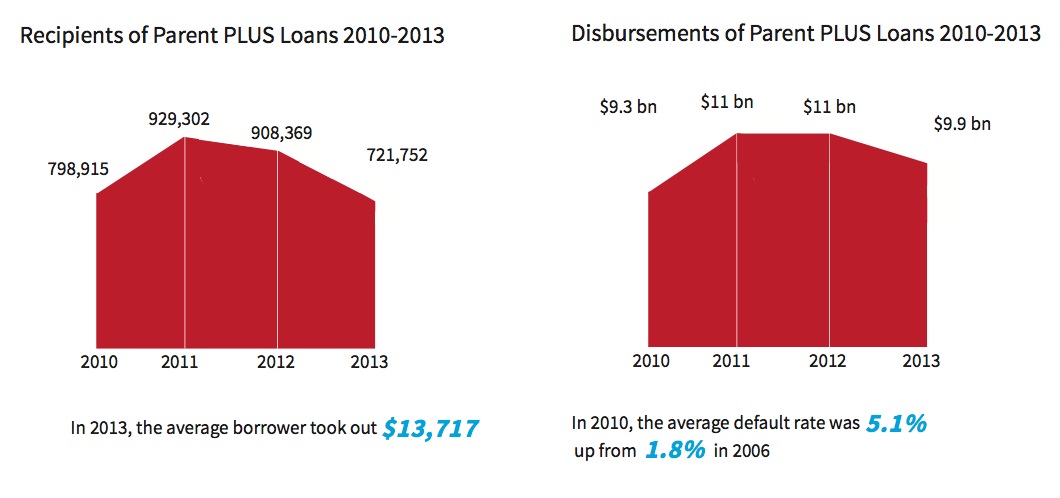

Data from the New America Foundation (Mallory Noe-Payne/WGBH).

Melanie's kitchen is filled with photographs of her family: her sons on their graduation days, Teyon on his wedding day, the three of them on a cruise for her birthday.

“This is my son graduating from the University of Hartford, so happy!" laughs Daye as she points to one, explaining that Antwane studied criminal justice and now works for Middlesex County as a correction officer.

With the housing market constantly changing, Melanie’s income hasn’t been steady, and she’s had to put off her loan payments. It’s been six years since her sons graduated from college and got jobs to support themselves, but Melanie now owes the government more than $130,000.

"I just have to think about money management," Daye said. "If I get a sale every month, I'll take half of that and put it toward student loans."

Unlike private loans, qualifying for Parent PLUS loans is relatively easy because the credit check requirements are low. Parents must demonstrate that they don't have an "adverse credit history."

Rachel Fishman is with the New American Foundation and she’s on a mission to convince the Department of Education to tighten its credit check.

“I think during this past recession, families turned to these loans more and more to help send their children to school,” said Fishman.

Since the recession, federal figures show the default rate on Parent PLUS loans has nearly tripled. Last year, just over 700,000 borrowers took out more than $9 billion in loans. According to Fishman, that indicates the government is issuing loans to families who really can’t afford them.

“It puts the federal government in a really difficult place, where it’s almost like predatory lending because the federal government has to give the parent the full amount of the money as long as they pass the credit check,” said Fishman.

Melanie Daye outside her home, that she owns, in Hyde Parke (Mallory Noe-Payne/WGBH).

Supporters of Parent PLUS Loans, though, say they increase access for low and middle-income families. Three years ago, the Department of Education did tighten its credit-check standards and many families counting on Parent PLUS Loans were denied. Enrollment, especially at historically black colleges and universities, plummeted.

Still, critics of the program argue the credit check should be even stricter.

Adam Reinke works with U-Aspire, a non-profit that provides financial college counseling to low-income students. He's seen lots of families turn to Parent PLUS Loans, and some schools even include the loan option as part of their financial aid package.

“We’ve seen some families take on more debt than they make in an entire year of salary,” Reinke said. “We’ve seen families just on public assistance benefits or Social Security with no income coming in, and yet still qualifying for these loans, simply because there is no income verification.”

Back in Hyde Park, Melanie Daye is optimistic. She has a real sense of pride in her work and in paying back her debt.

“I guess I’ll have to keep working hard and that’s all I can do. It’s part of living. Paying the bills, right?" Daye said. "You're responsible for something you took on. And you just do what you have to do and get it done. But it will get done… I know."

The Department of Education is currently re-evaluating eligibility requirements for the Parent PLUS Loan program. The most recent changes would make the loans easier to get.