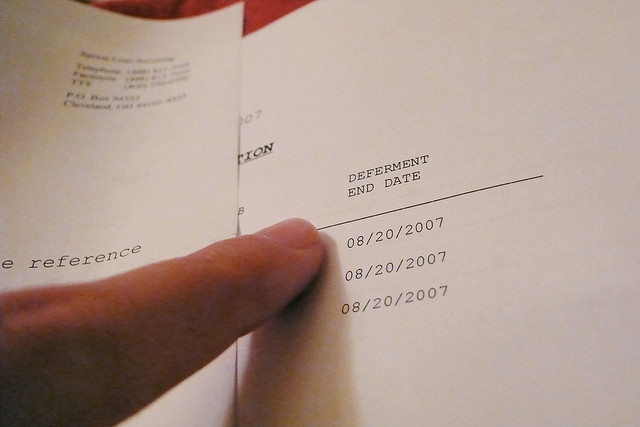

Student loan debt, and deferment rates, are one the rise. (Libraryann/Flickr)

For years, the Higher Education Act has set the ground rules for all federal financial aid to students. Now, the Act is up for reauthorization.

To prepare for the day when Congress has to give its stamp of approval on the massive bill, the Senate Health, Education, Labor, and Pensions Committee has begun holding hearings on provisions lawmakers want to re-evaluate.

On Thursday, the hearings focused on growing student-loan debt and how the federal loan program can help ease the problem of mounting debt, as well as increase access for lower-income students.

The Chronicle of Higher Education wrote about Thursday's hearings:

Suggestions (for improving federal student aid) included a simplified loan-repayment plan, additional information about borrowers’ options, and counseling to help guide students through the student-loan process, before and after taking out a loan. The practices of loan-repayment servicers and policies that allow overborrowing also came under fire during the wide-ranging discussion.

Massachusetts Senator Elizabeth Warren is a member of the committee. In the hearing, Warren questioned the profits the U.S. government makes off its student loan program, pointing to the fact that the government charges almost double the interest rate necessary to break even.

It seems to me we're just taxing students for the privilege of borrowing money to try to get an education. I think that's obscene.

Another major topic of debate is the regulation of for-profit colleges. Committee Chairman Sen. Tom Harkin (D-Iowa) tells NPR that for-profit colleges should be more accountable for the federal student aid they receive.

Keep your eyes out for a look at student loan debt from another angle from On Campus next week: parent loan debt.